Former Merrill Lynch senior vice president Jory Berkwits knows the financial industry inside and out, and during his career he has observed how technological advances and regulatory reform have combined to transform modern investing. Yet, in spite of many benefits like lower prices, instant access to information, and an increased focus on investor protection, most individual investors don’t trust Wall Street. Some even think the game is rigged in the favor of huge institutions and hedge funds.

Berkwits’ dinosaur is a metaphor for the fast disappearing Wall Street “cowboy,” and the hold-no-prisoners culture he thrived in. Wall Street used to be an exclusively male world, ferociously competitive, and heavy on type A personalities, who were completely at home in a work environment where more was better, and most was best.

Some, but not all, of the elements that made Wall Street what it is are fading away. Boiler-rooms are out; professional financial advisors and money managers are in. Strict regulatory compliance is expected of even the smallest firms. Online trading has made investing more transparent and less costly for all.

Yet the trust gap between Wall Street and investors remains, and if anything, it has grown larger. How did it get there? What can be done about it? Who needs to step up? If you are an investor, you’ll want to find out.

Holding his infant granddaughter in his arms for the first time, author Jory Berkwits was struck with a mix of emotions—as he imagined a future for the tiny newborn, he couldn’t help but reflect on his own past.

So when he stumbled on a class photograph taken in 1956 at Muhlenberg Elementary School in Allentown, Pennsylvania, he decided to do something with it. He returned to his hometown for the first time in almost forty years.

He was startled to find just how much things had changed.

During subsequent trips to Allentown, Berkwits located former classmates and rekindled friendships, but most of all he wanted to understand why and how the mid-twentieth-century boomtown had succumbed to blight, and whether it would ever be able to recover.

The result is My Bittersweet Homecoming—a moving look at growing up and going home again, and the effect of deindustrialization on middle-class America.

Part nostalgic exploration and part anecdotal history, My Bittersweet Homecoming will speak to anyone who grapples with the passage of time.

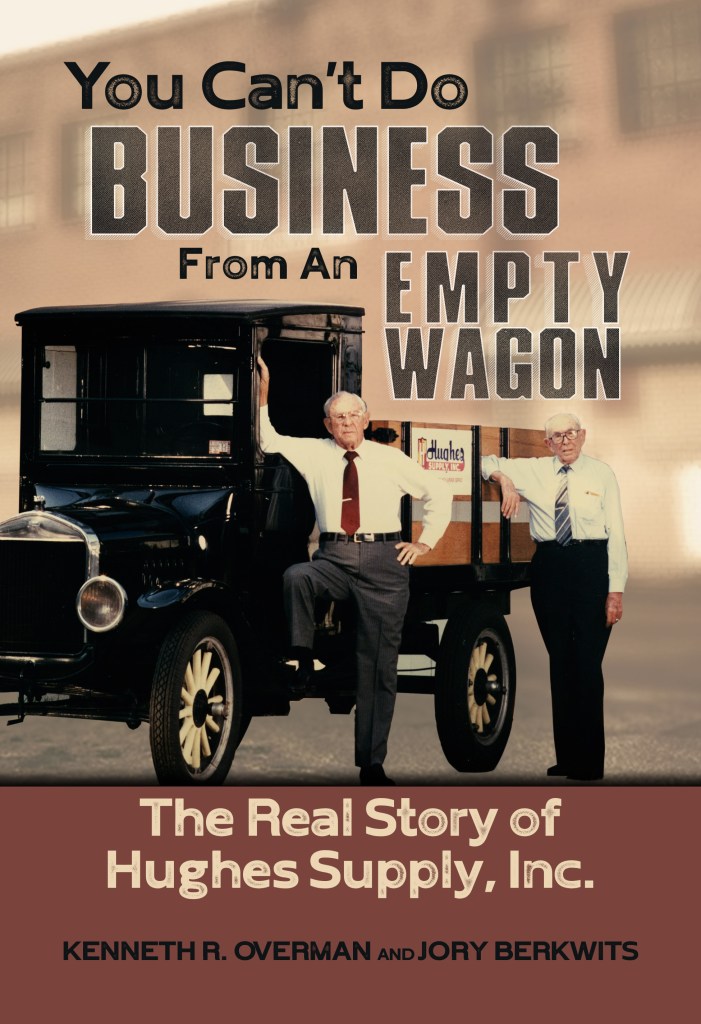

It Started with Two Men and a Loaded Truck. Hughes Supply was founded in 1928 by two young brothers, Russell and Harry Hughes in Orlando, Florida, a sleepy town of 10,000. With the help of a local bank loan and their modest savings, the two purchased their first stock of supplies and went to work. All they needed was a used truck and space in their garage. Russell and Harry built their company brick by brick. Starting in Orlando, the firm expanded across Florida, into the Southeast, and eventually throughout the country. When their children—David, Vincent, and Russell Jr.—took the reins in the 1970s, Hughes Supply went public. In 2006. Hughes Supply was sold to The Home Depot for $3.5 billion. While a complete success in financial terms, the sale devastated the company’s culture, and indeed its very soul. For the thousands of employees who considered themselves a member of the extended Hughes family, this was particularly hard to swallow.

Nevertheless, they still look back with pride at a job well done. The success of Hughes Supply was tied to two principles: absolute focus on customer service and strong employee development. This book tells the whole story. It will keep the legacy of Hughes Supply alive forever.